Sticking to the Plan: Why We Don’t Let Headlines Drive Decisions

“Games are won by players who focus on the playing field – not by those whose eyes are glued to the scoreboard.” – Warren Buffett

I wanted to share this quote with you because I believe that one of the biggest threats to long-term investment success is paying too much attention to the value of our investments today. Our financial plans are designed to feed, clothe and house our families in the future. It is important to be aware of our portfolio values but not to make it our focus.

We at Thomson Allison want to deliver pleasing investment results to you over the long term. If seeing higher investment values in the short term seems pleasing to you, I encourage you to temper this in the same way that I would encourage you to temper your perspective had the value of your investments gone down in 2024.

In October 2022 (when markets were down over 10% year-to-date) I wrote “a decision to remain committed to a long-term investment plan is easy when markets are up, and difficult when they are down.” Our investment values have increased substantially since then. If it feels easy to be invested the way you are now, please remember that there will be times in the future where it will feel difficult. We will remain committed to our approach regardless of how we feel.

Some Themes From 2024

Monetary Policy vs Political Theatre

Some of you expressed concern that the 2024 US election results could lead to instability in our world and in the value of your investments. I wanted to provide you with some examples of destabilizing news and how efficient the stock market is at anticipating and adapting to new information:

On December 1, 2024 United States president-elect Donald Trump announced that he would impose 25% (or higher) tariffs on imports from Canada, Mexico and China when he comes to power. Stock markets remained unchanged that day.

On December 23, 2024, Donald Trump again announced that he would “lock down” the US border. He openly discussed the possibility of purchasing Greenland from Denmark and indicated that he was willing to retake the Panama canal from Panama. Stock markets were unchanged that day.

On December 17, 2024, Jerome Powell, chairman of the US Federal Reserve Board, announced an interest rate reduction of .25%. In his comments, he led investors to believe that the board may not proceed with as many further interest rate reductions in 2025 as they had anticipated. The Dow Jones Industrial Average dropped over 1,000 points (~3%) that day.

I am highlighting these three announcements to remind you that professional investors are watching, listening to and reading the news in the same way that we are. When information is broadcast that seems credible and actionable (see #3), they will move quickly and decisively as they did on December 17. They are not ignoring Donald Trump (see #1 and #2) but they do not place much credibility in his claims so they are not acting on them. Much of what we see coming from politicians is interesting to hear, but it often amounts to nothing more than political theatre and has little to no impact on our investment plans.

Canadian Dollar vs US Dollar

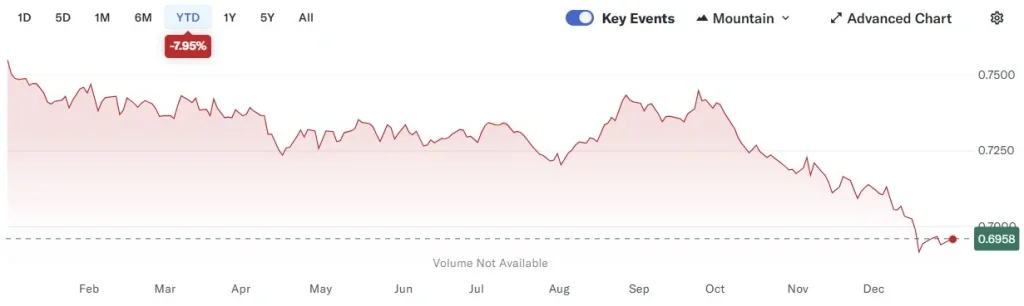

(Source: yahoo.ca/finance)

The US dollar and economy continued to dominate all others. Over the course of the year, the Canadian dollar dropped from over 75 cents in USD to less than 70 cents. This is a decrease of 7.95%. Most of your investments are held in US-based securities so this had the effect of increasing your rates of return in Canadian dollars.

Magnificent Seven vs All Others

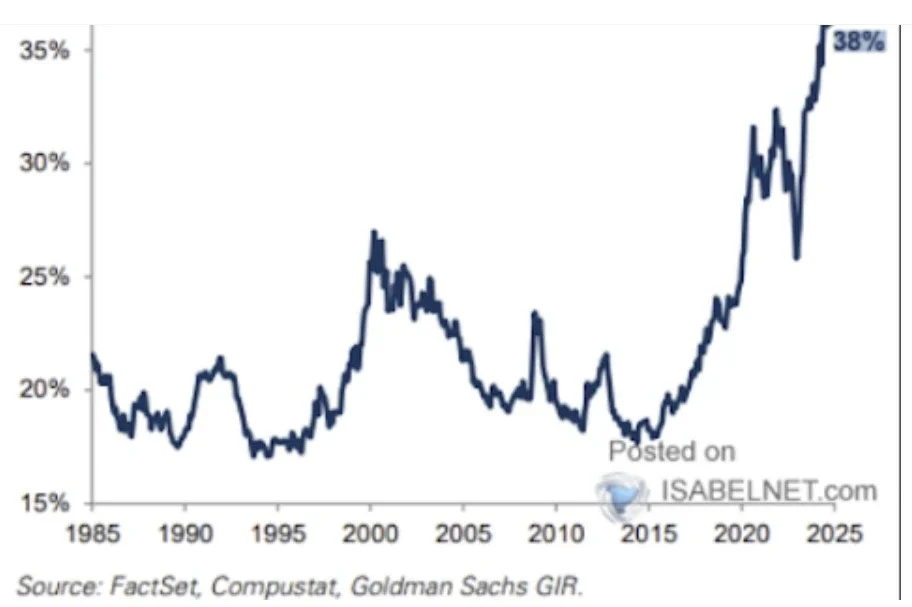

(Source: TSX.com, yahoo.ca/finance)

“Magnificent Seven” is a term that has come to represent the seven dominant technology companies in the United States. These companies are: Apple, Meta (Facebook), Alphabet (Google), Nvidia, Microsoft, Tesla and Amazon. The chart on the left shows that their combined value is close to 40% of the value of all the largest businesses in the US. Much attention is paid to these seven stocks for many reasons, the least of which is simply their sheer value. Consider, for example, the value of Apple Inc. It would cost you $5.2 trillion CAD to purchase the entire business. If you added up the value of ALL the companies listed on the TSX (Canadian stock market), it would total $4.2 trillion CAD. To be clear, if you owned one business (Apple Inc.) and sold it to someone else, you would have enough money to purchase EVERY publicly-traded business in Canada (all the banks, railroads, pipelines, energy companies etc.) and still have $1 trillion left over for spending money . We remain concerned that the value of these seven companies is so overwhelmingly high. I should also note that EdgePoint does not currently hold any shares of the magnificent seven in its portfolios. In the index funds (RBC US Equity Index), the magnificent seven are dominant.